CM Mamata holds Centre responsible for Kashmir tourist safety in meeting with Omar Abdullah | Watch

.gif)

.gif)

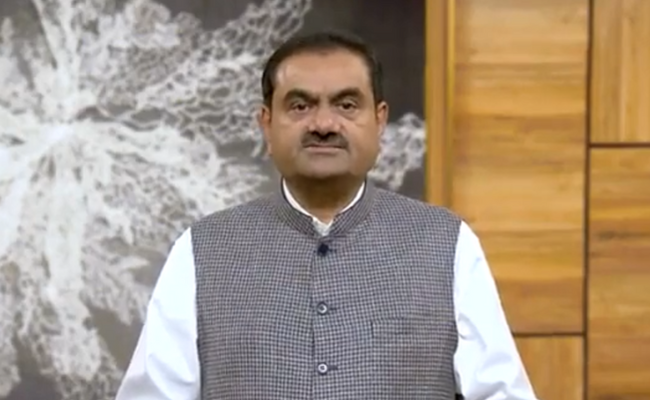

Gautam Adani, on Thursday, speaking on his company's withdrawal from FPO said that the board felt it would be morally incorrect to proceed with it considering the volatility of the market. He said the move was taken in the best interest of the investors and to save them from potential losses.

On February 1, Adani Enterprises withdrew their fully subscribed FPO of Rs 20,000 crore. The decision was taken in a board meeting after the organization's stocks plummeted amidst the Hindenburg row.

"Considering the volatility of the market seen yesterday, the board strongly felt that it would not be morally correct to proceed with the FPO," Adani said in his speech. He added that in his journey of over four decades as an entrepreneur, he has received "overwhelming support" from all stakeholders and particularly the investor community.

Expressing his gratitude toward investors for trusting him, he said, "For me, the interest of my investors is paramount and everything is secondary. Hence to insulate the investors from potential losses we have withdrawn the FPO." Adani further said, "This decision will not have any impact on our existing operations and future plans. We will continue to focus on timely execution and delivery of projects."

"The fundamentals of our company are strong. Our balance sheet is healthy and assets, robust. Our EBIDTA levels and cash flows have been very strong and we have an impeccable track record of fulfilling our debt obligations. We will continue to focus on long-term value creation and growth will be managed by internal accruals. Once the market stabilizes, we will review our capital market strategy," he added.

Watch his video statement here: