CM Mamata holds Centre responsible for Kashmir tourist safety in meeting with Omar Abdullah | Watch

.gif)

.gif)

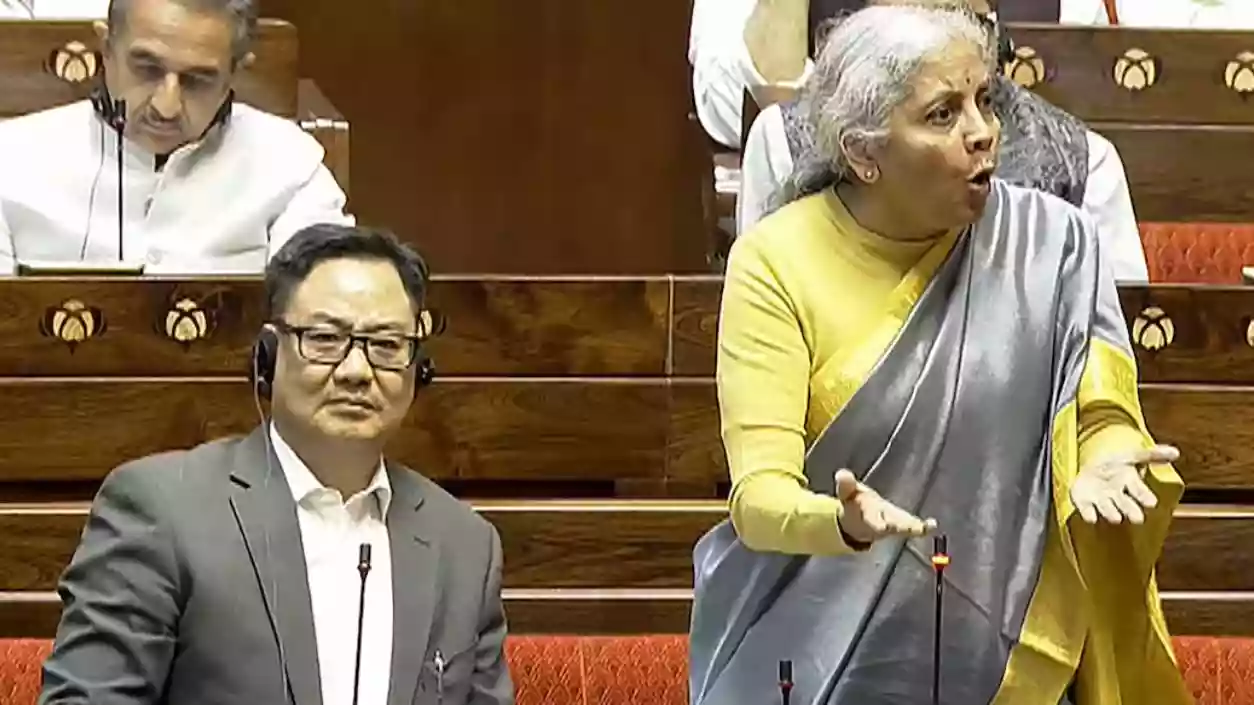

Finance Minister Nirmala Sitharaman introduced the Income Tax Bill 2025 in the Lok Sabha on Thursday, proposing a complete overhaul of India’s six-decade-old tax framework. The bill aims to simplify tax laws, modernize terminology, and remove outdated provisions while ensuring greater transparency and ease of compliance. Despite strong opposition, the bill was introduced through a voice vote and has now been referred to a Joint Parliamentary Committee (JPC) for further review. The bill, once passed, will replace the Income Tax Act, 1961, and is expected to be implemented from April 1, 2026.

The proposed legislation reduces the number of sections from 819 to 536 and shortens the tax law from 823 pages to 622. Key changes include replacing “assessment year” and “previous year” with “tax year”, eliminating redundant sections such as those related to fringe benefit tax, and introducing structured tables for tax calculations. However, it does not alter existing tax slabs or rebate structures. According to the Finance Ministry, the new tax system is built on five core principles—Streamlined, Integrated, Minimized litigation, Practical, Learn and adapt, and Efficient (SIMPLE)—to make tax compliance easier.

The bill faced strong resistance from opposition leaders. Congress MP Manish Tewari and RSP MP NK Premchandran argued that the changes make tax laws more complex rather than simplifying them. Trinamool Congress MP Saugata Roy criticized the bill, calling it “mechanical.” In response, Sitharaman defended the reforms, stating, “The number of words has been reduced by half, sections and chapters have been cut, making the law more concise.” She also emphasized that the changes aim to streamline tax provisions and reduce litigation.

Following its introduction, the bill was referred to a Joint Parliamentary Committee (JPC), which will review the proposed changes and submit its report by March 10, 2025. The committee’s composition and guidelines will be decided by Lok Sabha Speaker Om Birla. Once reviewed, the bill will return to Parliament for final approval, after which the government will determine its rollout timeline. Sitharaman earlier stated, “Once Parliament passes it, we will decide the best time to roll it out.”

The new bill is part of the government’s ongoing tax reforms to make tax laws clearer, more accessible, and legally robust. While it does not introduce new tax rates, it removes archaic clauses, aims to reduce legal disputes, and simplifies compliance for taxpayers. The Finance Ministry has made the full bill and FAQs available on its official website, providing clarity on its objectives and expected impact.