Kasba Gangrape: Court sends all 3 accused to 7-day police custody

.gif)

.gif)

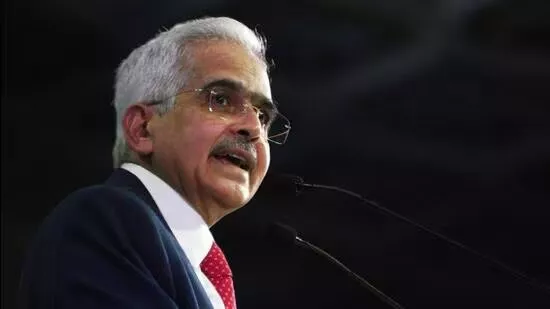

In a crucial decision, the Reserve Bank of India (RBI) announced on Friday that it would maintain its benchmark repo rate at 6.5%, marking the fourth consecutive time it has held rates steady. RBI Governor Shaktikanta Das emphasized the central bank's commitment to a policy focused on "withdrawal of accommodation" to combat rising inflationary pressures in the Indian economy.

The decision comes amidst concerns about elevated food prices potentially spilling over into other sectors and causing persistent inflationary pressures. Despite a silver lining in the form of declining core inflation, Das warned of continued risks to inflation stemming from factors such as a potential decline in summer sowing and global economic slowdown.

Shaktikanta Das expressed apprehension over recurring food price shocks, highlighting the risk they pose to overall inflation. The central bank's monetary policy strategy centers around curbing money supply in the economy to control inflation.

Although vegetable prices saw some relief in August, Das expects further declines in September. However, he remains watchful of potential inflationary pressures, especially from food prices, which can impact various sectors of the economy.

Despite the inflationary concerns, the RBI remains cautiously optimistic about India's economic growth. The central bank forecasts a real GDP growth of 6.5% for 2023-24, with a projected growth rate of 6.5% in July-September 2023. While high cereal prices and the threat of El Nino weather patterns continue to be variables influencing inflation, the RBI's decision to keep rates unchanged signals its commitment to balance economic growth with inflation control. This move follows a series of repo rate hikes earlier in the year, with the central bank opting for a pause in its April policy review.

The RBI's decision underscores the delicate balance between fostering economic growth and taming inflation, with a close eye on food prices and global economic trends shaping India's economic outlook for the coming months.