.gif)

.gif)

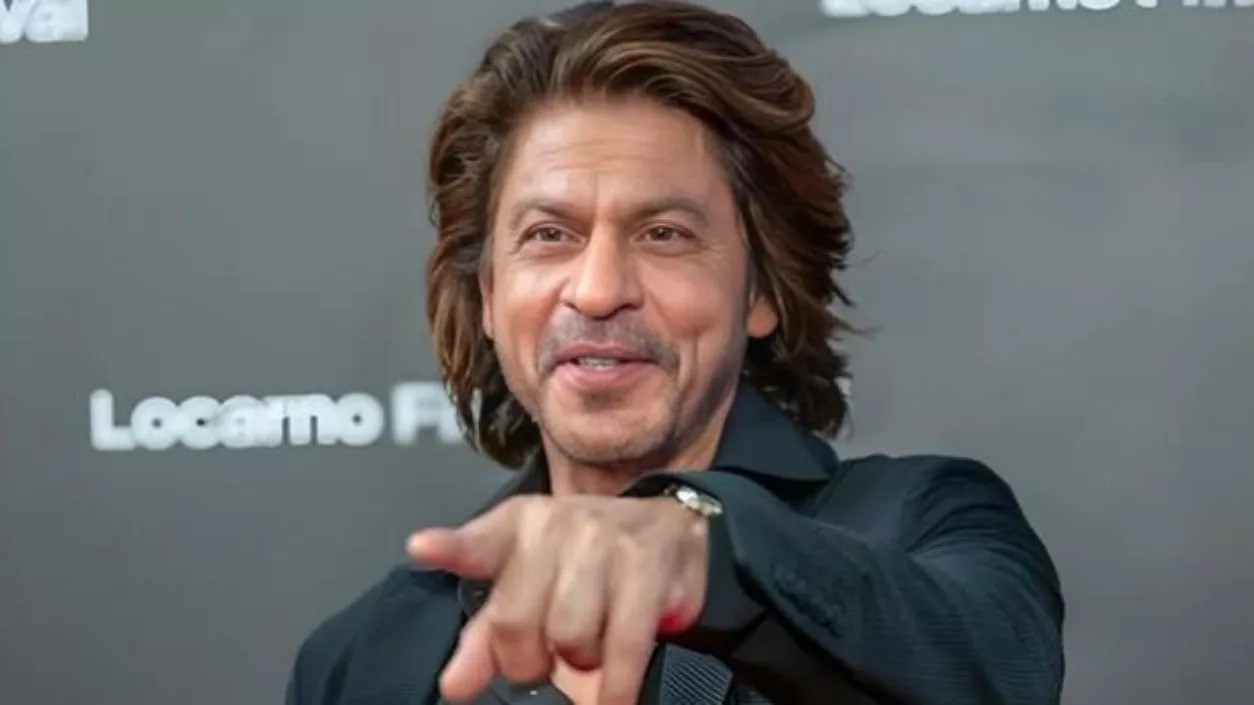

Bollywood actor Shah Rukh Khan has won a major tax dispute after the Income Tax Appellate Tribunal (ITAT) ruled against the reassessment order issued by the Income Tax Department for the financial year 2011-12. The case centered around Khan’s declared income of ₹83.42 crore, which included earnings from his film RA.One. The tax authorities had rejected his claim for foreign tax credit on taxes paid in the UK and reassessed his income at ₹84.17 crore, initiating proceedings more than four years after the original assessment.

The ITAT ruled that the reassessment was legally invalid as the tax authorities did not present any “fresh tangible material” to justify reopening the case beyond the statutory four-year period. The tribunal noted that the issue had already been examined during the initial assessment and stated, “The assessing officer failed to demonstrate any new material justifying the reopening of the case.” ITAT further stated that the reassessment proceedings were "bad in law" due to multiple legal shortcomings.

The dispute arose because Khan’s agreement with Red Chillies Entertainment specified that 70% of RA.One would be filmed in the UK, making a proportionate portion of his income subject to UK taxation. His remuneration for the project was routed through Winford Production, a UK-based entity, leading to tax deductions under UK laws. The Income Tax Department argued that this structure resulted in a revenue loss for India and denied Khan’s claim for foreign tax credit.

The reassessment process was initiated more than four years after the original filing, which exceeded the statutory time limit unless new and substantial evidence justified the review. ITAT ruled that the department had failed to provide any such evidence, making the reopening of the case legally untenable. The tribunal’s decision nullified the reassessment order and upheld Khan’s original tax filings for that financial year.

This ruling prevents any additional tax liabilities for Khan and reinforces the legal requirement that reassessment proceedings must be based on fresh and substantive evidence. The Income Tax Department has not yet commented on whether it plans to challenge the ITAT ruling.