.gif)

.gif)

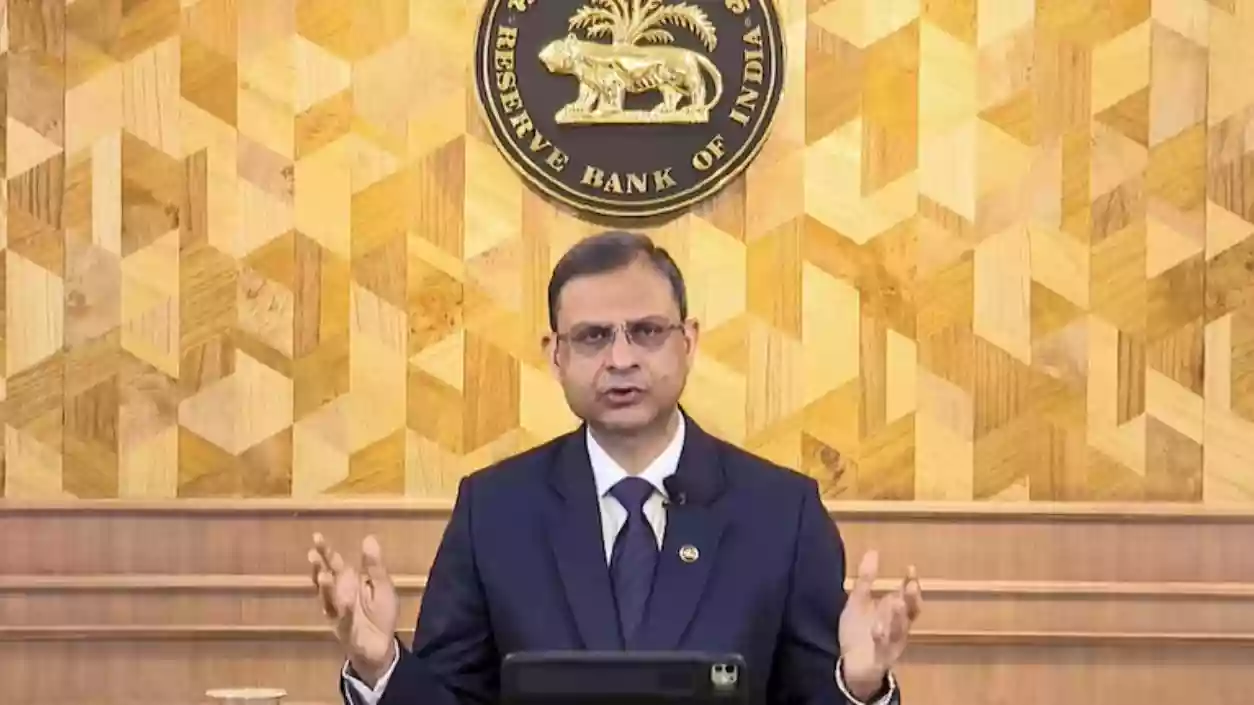

The Reserve Bank of India (RBI) has reduced the policy repo rate by 50 basis points, bringing it down from 6% to 5.5% with immediate effect. The decision was announced by RBI Governor Sanjay Malhotra after the conclusion of the three-day Monetary Policy Committee (MPC) meeting held on June 4, 5, and 6. This is the second consecutive rate cut in 2025, following a 25 basis point reduction in April.

Governor Malhotra said, “The Monetary Policy Committee met on June 4, 5, and 6 to deliberate and decide on the policy repo rate and also the detailed assessment of the evolving macro-economic and financial developments and the economic outlook ahead. The MPC has decided to reduce the policy repo rate by 50 basis points to 5.5 per cent with immediate effect.” He added that the committee undertook a comprehensive review of both domestic and international economic conditions before finalising the move.

Along with the rate cut, the RBI also changed its policy stance from ‘accommodative’ to ‘neutral’. The repo rate is the interest rate at which the RBI lends money to commercial banks. A reduction in the repo rate is expected to lower interest rates on home loans and other retail credit. The decision is aimed at supporting credit growth and economic activity across sectors.